Emerging Confectionery Flavors Shaping the Future of Confections: (October 2025 - December 2025)

Feb 19, 2026

The confectionery market is evolving as traditional tastes meet modern lifestyles, creating new opportunities for confectionery flavor suppliers. While classic candy flavors, lollipop flavors, bubble gum flavors, and toffee flavors remain popular, consumers are increasingly seeking multi- dimensional experiences and texture profiles that balance sweetness with contrasting notes such as salt, acid, or spice—along with sensory descriptors like crunchy, chewy, creamy, smooth, fizzy, or layered. This trend offers confectionery flavor manufacturers the opportunity to develop memorable flavors that evoke emotion, nostalgia, and delight beyond simple sugary indulgence.

The Indian Confectionery Market:

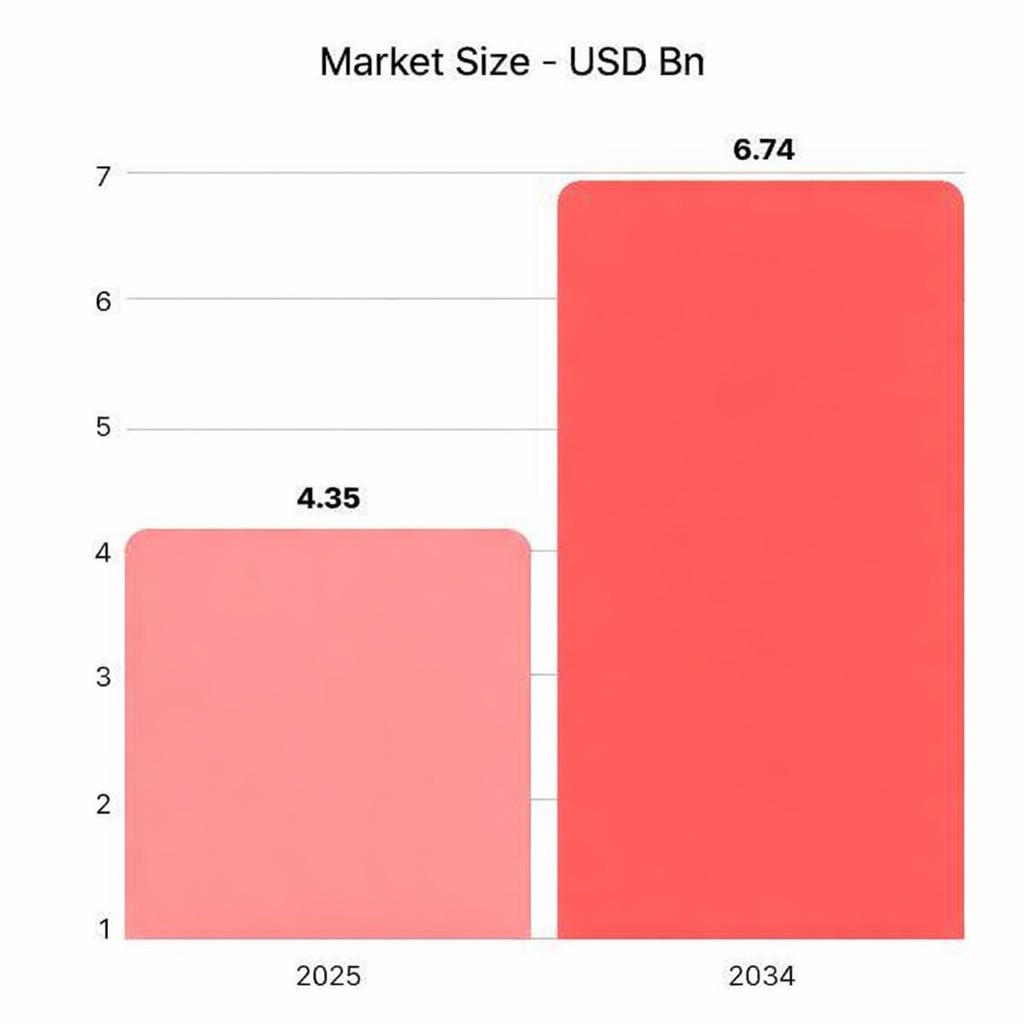

- The Indian confectionery market, valued at USD 4.35 billion in 2025, is projected to reachUSD 6.74 billion by 2034, growing at a CAGR of 4.99% during 2026–2034 [1]

- Chewy candies and gummies are driving 4 premiumisation through healthier propositions and novel formats.

- Traditional boiled sweets, toffees, and caramels continue to dominate impulse purchases, supported by growing gifting trends and demand for quality packaging.

Key Trends Driving Market Growth

Rising concerns about sugar intake, obesity, and diabetes are driving demand for low or reduced-sugar candy, lollipop, and toffee flavor.

At the same time, parents are increasingly influencing purchase decisions, boosting interest in natural confectionery flavours & ingredients with functional benefits. [2]

Indian consumers are increasingly seeking novel, adventurous flavors and engaging textures that deliver multi-sensory, premium experiences.

This is driving product trials, repeat purchases, and innovation- led differentiation, particularly in flavours of cotton candy and other exciting confectionery flavours.[2]

Continuous innovation that blends traditional and ethnic tastes with modern formats is attracting consumers.

Newstalgia-inspired profiles, such as toffee and candy flavors, evoke emotional connections and cultural pride, broadening overall appeal. [3]

Urban lifestyles, social media influence, and the rapid growth of quick commerce are driving demand for greater variety, novelty, and convenience in confectionery products.

Evolving candy flavor innovations and diverse lollipop flavors are capturing growing consumer interest.[3]

To explore customized confectionery flavours solutions that blend tradition with modern consumer preferences, connect with AARAV at marketing@aarav.co

AARAV’s Confectionery Flavors Outlook 2026

Develop herbal, ayurvedic, and spice-led candy and lollipop flavours using ginger, saunf, cinnamon, mints, and fruit blends.

These formulations should deliver functional benefits such as throat soothing, digestion support, oral care, immunity, and energy across confectionery flavours. [3]

Tap into the growing appeal of sweet–sour, sweet– salty, and sweet spicy confectionery flavours that resonate strongly with Indian women.

Use intense sour notes in lollipop flavors and playful combinations like honey–lime, tamarind masala, and guava masala in candy flavors and gums. [2]

Introduce bold candy flavors and lollipop flavors with combinations like fruit blends (apple–grape, blueberry– cherry) and sweet–tangy or fresh profiles (orange– lemon–mint, Mint Chocolate, Dark Chocolate-Orange) to stand out.

These unique combinations help confectionery flavours manufacturers differentiate their offerings in the competitive confectionery flavours market. [2]

Focus on multi-textured formats—centre-filled candies, gum-filled lollipops, and sugar-sprinkled jelly strips.

Leverage chewy, gelled, creamy, or crunchy textures to enhance flavour, appeal, and brand differentiation in global and Indian markets.

FAQs

[1]India Confectionery Market Statistics & Analysis | Report, [2033]. (n.d.). https://www.imarcgroup.com/india-confectionery-market

[2]Mintel. (n.d.). https://clients.mintel.com/content/report/sugar-gum-confectioneryindia-%202025#workspace_SpacesStore_88621702-4e0f-4d51-91f0-3a3e7c20a717

[3]Euromonitor Login. (n.d.). https://www.portal.euromonitor.com/analysis/tab